A study by Sierra Quadrant shows that many Romanian companies are not prepared to attract EU recovery funds, so the country may not be able to access a good part of the 30 billion euros from the National recovery and resilience plan, Romanian news portal ziare.com reports. However, Romanian companies, struck by the epidemic and the economic crisis it brought, may need these funds to recover, especially if the state’s economic support measures are withdrawn.

Romanian companies entered the COVID-19 crisis with a series of significant vulnerabilities: They were poorly capitalized, lacked financial discipline, were focused on short-term profits, and had a low volume of financial intermediation (the lowest in the EU). That is why most of the companies, especially SMEs, were hit hard by the crisis, both in terms of demand and supply. According to ziare.com, these vulnerabilities will continue to influence the economy this year.

“The economy is like a living organism, drained of blood (money). Without the financial infusion provided by European funds, it is unlikely that the economic recovery will be a sustainable one, especially because the state will be forced to impose restructurings in order to balance its budget,” Ovidiu Neacșu, associate coordinator at Sierra Quadrant, told ziare.com.

According to Neacșu, the problem is that Romanian companies do not have the logistic capacities to attract European funds, and only 2 of 10 companies meet the criteria to obtain financing. “There are only around 10,000 companies in Romania with turnover of more than 1 million euros, so the potential for absorption of European funding at an optimal level raises questions. So in 2021, the companies that would like to have access to the funds will have to restructure their businesses, must adapt them to EU standards, and must secure the financial lines needed to co-finance their programs with European money. And they must take action now,” the representative of the Sierra Quadrant explained.

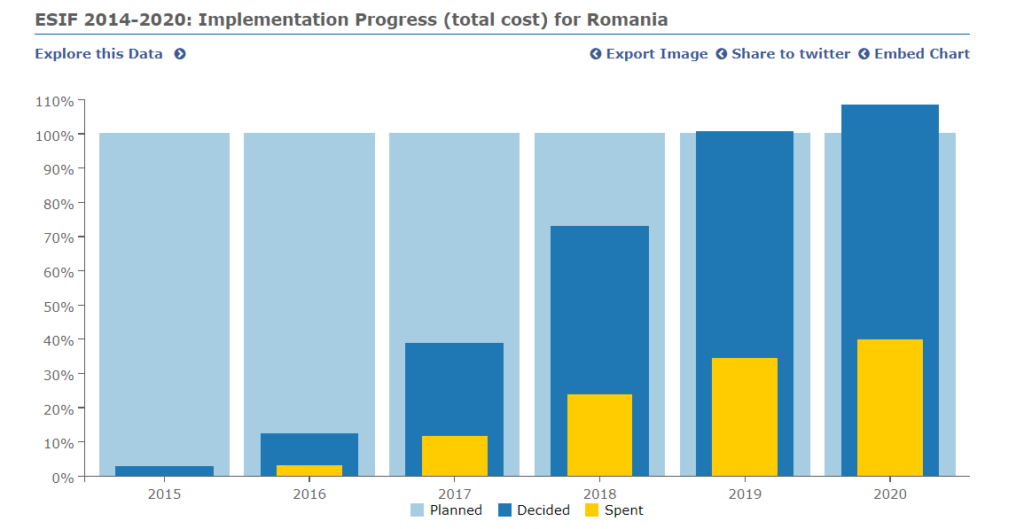

The European recovery and resilience plan’s EUR 750 billion, added to the more than EUR 1 trillion EU budget, will double the funds for Romania in the 2021-2024 period. The money from the resilience program should be absorbed in the next three years, together with the funds from the multiannual financial framework. Although, for years and years, Romania had the lowest absorption rate in the entire EU, in 2020, the country reached a 38.9 percent absorption rate, meaning they managed to access EUR 8.8 billion from the allocated 22.5 billion for cohesion policy. The authorities have 9,145 financial contracts in progress, for a total value of EUR 36.4 billion.

The epidemic significantly influenced the Romanian economy: On the one hand, it caused a decrease in revenues of approximately EUR 70 billion, but, on the other hand, it accelerated the restructuring and modernization of the economy. Digitalization was implemented by more companies, online payments also increased, while some inefficient companies disappeared from the market — all of which will be accentuated this year. “Based on the anticipated measures to make the collection of taxes and duties more effective, companies will have to strengthen their financial discipline and monitor their business partners because the risk of non-payment, of insolvency, will increase exponentially when the support measures are withdrawn (postponement of taxes, bank rates, leases, etc.),” the analysis of Sierra Quadrant shows.

According to the study, undercapitalized companies hold 33 percent of the total debt in the Romanian economy and represent 12 percent of the total exposure to the banking sector. “Payment difficulties can be passed along the economic chain very easily, especially given that trade credits represent about 20% of liabilities (RON 300 billion),” the analysis shows. Ovidiu Neacșu pointed out to ziare.com that the Romanian government’s economic support measures were very helpful, but these should now focus on viable companies to ensure their benefits are felt throughout the economy and to strengthen the financial discipline of companies.

According to the statistics, the aviation sector was the most affected by the epidemic in 2020, with a decrease of 84 percent, followed by services for the general public, where activities dropped by 67 percent in the second quarter of 2020 versus Q2 2019. In the same time period, fuel sales dropped by 27 percent. In the pharmaceutical industry, as well as in the food industry, activity decreased by 10 percent. Among the most affected sectors was the automotive industry, with a decrease of 48 percent. Due to the restrictive measures, companies in the hotel and restaurant sector reached a degree of indebtedness of 115 and 217 percent.

Official data show that trade registered in September hit a non-performing rate of 4.7 percent, below the value of all non-financial companies (6.7 percent).

On the other hand, the epidemic brought positive performances in, among others, the retail trade of food, beverages and tobacco (up 12 percent in Q2 2020 over Q2 2019); postal and courier activities (23 percent); and construction (11 percent).

According to the study of Sierra Quadrant, 58 percent of the interviewed company representatives admitted that their company had enough funds to cover the next one or two months. Another 22 percent estimated they have enough for two to four months, and 8 percent do not have any liquidity; meanwhile, only 12 percent have financing available for longer than four months. Most of the company representatives said that they ended up in this situation as a result of a decrease in sales (61 percent), increased failures to meet financial obligations (14 percent), reduction of supplier credit (12 percent) and limited access to bank financing (8 percent).

In order to balance their budgets during the epidemic, most companies have reduced their operational costs. Aside from postponing the payment of taxes to the state, invoked by 21 percent of the companies surveyed, most (41 percent) reduced their logistics costs, 27 percent changed their pricing policies, and 9 percent resorted to optimizing staffing schemes.

“In 2021, companies will have to fine-tune their feasible business plans, which should take into account the evolution of the pandemic and the potential economic recovery. The sooner they understand the economic reality, the better they will succeed in resource optimization to emerge from this crisis ahead. Flexibility of contracts, reducing supplier credits, active management of financial lines, release of additional amounts from the balance sheet, and the general rebalancing of costs based on revenue forecasts, along with a reconsideration of all investments will best help companies, no matter how much longer the epidemic lasts,” the Sierra Quadrant analysis underlines.

Title image: The epidemic brought positive performances in the retail trade of food, beverages and tobacco; postal and courier activities; and construction