In the 2008–2021 period, deposits by Romanian companies have doubled, but loans have increased by only 25 percent, thus remaining below the rate of inflation, the latest analysis from ErdélyStat reveals. Transylvanian companies opted for cautious money management during the COVID-19 pandemic.

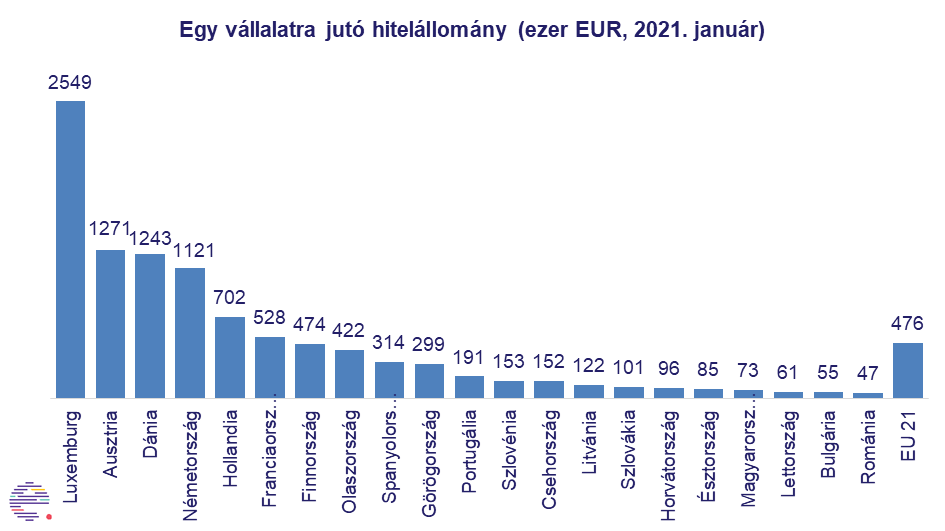

Romania had 539,125 active companies (not including companies providing financial services), which had a total loan balance of EUR 25.6 billion in January 2021, according to ErdélyStat. The loan balance of EUR 47,000 per active company puts Romania in last place in this segment of EU member state rankings.

The research company also checked the deposit balance of Romanian companies: In January 2021, the grand total was EUR 29.8 billion, or EUR 55,274 per active company. That secures Romania the penultimate spot in this segment of EU member state rankings, just before Bulgaria.

According to ErdélyStat’s report, the total loan balance of Transylvanian companies accounted for 32.2 percent of the country total. The total loan balance of EUR 7.4 billion (EUR 33,000 per active Transylvanian company) in January 2021 paints a positive picture, with financial stability matching that of 2019, the year before the COVID-19 pandemic.

After checking the deposit balance of Transylvanian companies, the research company found that the EUR 7.2 billion accounts for only a quarter of the country total. An interesting piece of information is that the EUR 25,000 deposit per active company accounts for only 25 percent of the Bucharest-based company average.

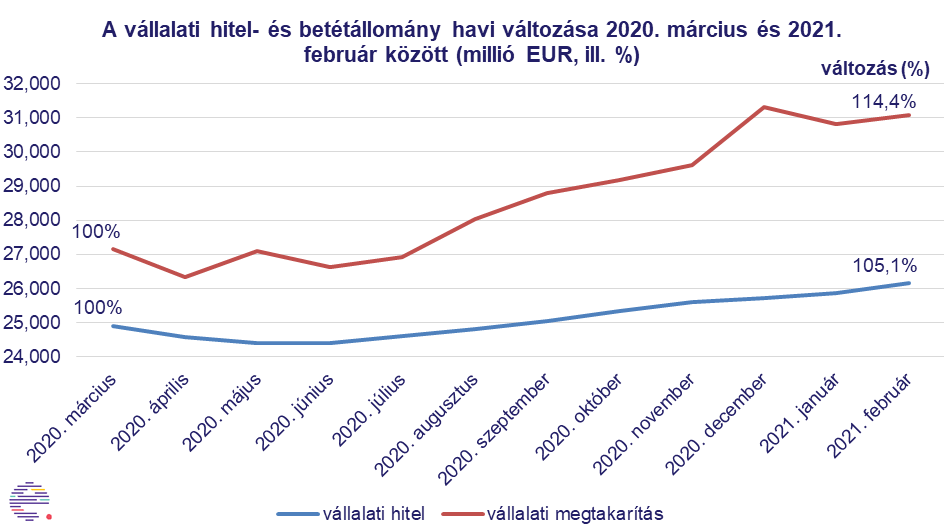

Transylvanian companies were more careful with loans in the year of COVID-19 (between March 2020 and February 2021), as the loans balance increased only by 5.1 percent, compared to cash deposits, which were up 14.4 percent, a phenomenon never before seen in the 2008–2020 period, the researchers note.